Bilateral Real Exchange Rate

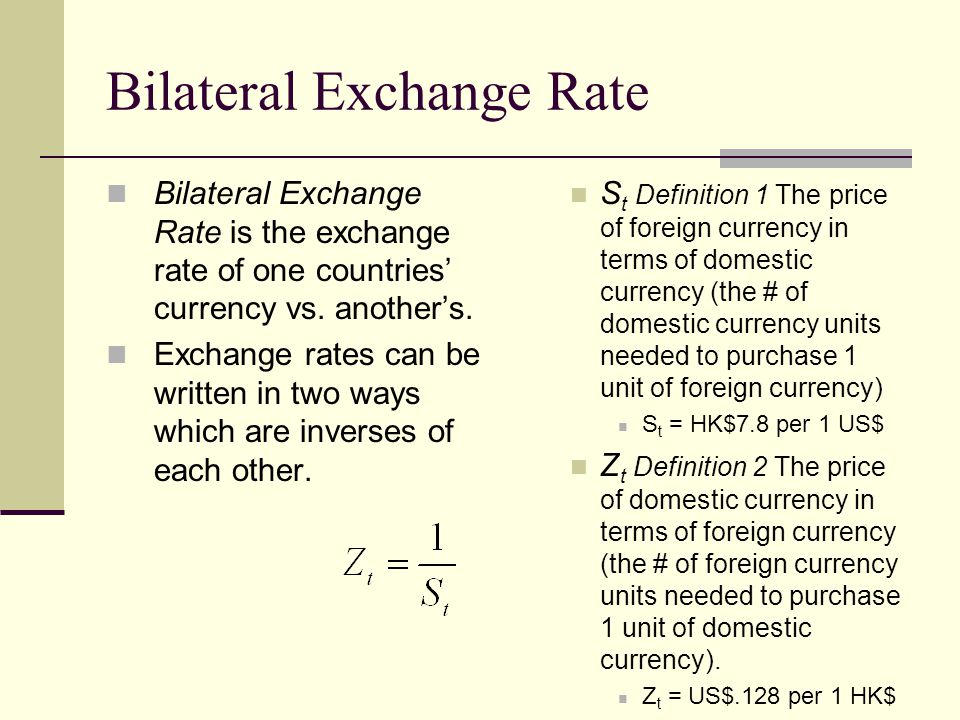

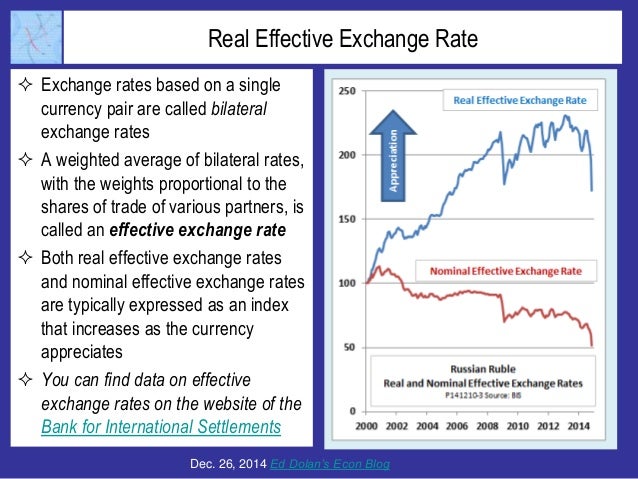

Bilateral exchange rate involves a currency pair while an effective exchange rate is a weighted average of a basket of foreign currencies and it can be viewed as an overall measure of the country s external competitiveness.

Bilateral real exchange rate. Generally speaking the trade weighted index is a. Data series start at the beginning of 1970 and run to the last available data point. Regardless of the way in which reer is calculated it is an. Multilateral real exchange rate index itcrm and bilateral.

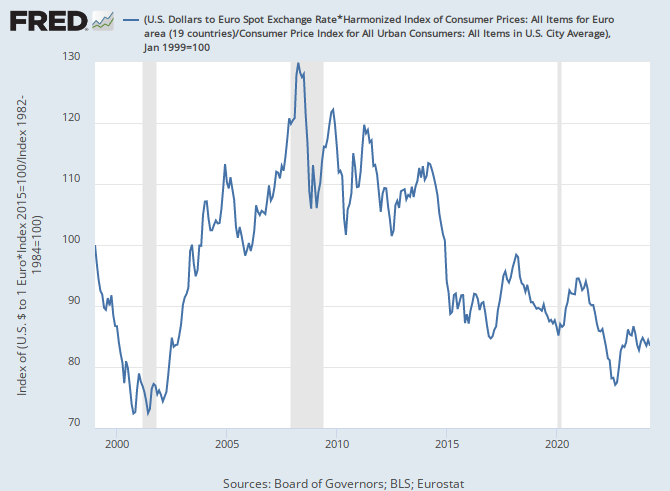

Real and nominal multilateral exchange rate indices. In particular the volume of the real exports from one country to the other is a function of the bilateral real exchange rates between the two countries and other economic variables such as the gdp of the importing country the bilateral real exchange rates between the importing country and another exporting country say korea as a competitor to china in the us market and germany as a competitor to the us in the chinese market and exchange rate volatility. One popular variable that you can create is a bilateral real exchange rate index. Bilateral real exchange rate or real effective exchange rate for the foreign price index we have to choose what country will be included in the calculation of the real exchange rate.

Dollars a real exchange rate is the relative price of consumption baskets in two countries. Some calculations use bilateral exchange rates while other models use real exchange rates which adjusts the exchange rate for inflation. This is the exchange rate after being adjusted for the effects of inflation it therefore more accurately reflects the purchasing power of a currency. The exchange rate is essentially a multilateral exchange rate which is designed to represent the weighted average of the various exchange rates with both domestic and abroad currencies with the foreign currency being the same as that nations share in trade hence the term trade weighted index.

All series are updated quarterly. While a nominal exchange rate is the relative price of 2 monies e g the relative price of a euro in terms of u s. It includes both bilateral nominal and real exchange rates for 79 countries plus the european union as well as real trade weighted exchange rate indexes for many commodities and aggregations. The reer is an average of the bilateral rers between the country and each of its trading partners weighted by the respective trade shares of each partner.

The real exchange rate can be calculated between only two countries bilateral real exchange rate but we can also take multiple countries into account multilateral real exchange rate. Floating exchange rate when the value of the currency is determined by market forces supply and demand for currency.